We reran our most successful investment methodology using Gemini 3 Pro.

In 2023 we used GPT-4 to design a “most investable” hypothetical stock and found a real-world match that returned 117% vs 15.9% for the S&P 500. Here we rerun that process with Gemini 3 Pro and share the new thesis it surfaces.

📶BUY-$LWLG and hold till December 9th, 2026.

📶BUY-$AVGO and hold till December 9th, 2026.

📶BUY-$NVDA and hold till December 9th, 2026.

On August 7, 2023, we used a structured methodology powered by GPT-4, then the most advanced AI model available, to generate a stock recommendation. That pick became our most successful recommendation, delivering a 117% return, compared with 15.9% for the S&P 500 over the same period.

We have now applied the same methodology with Gemini 3 Pro by Google, arguably the most advanced AI model today, to generate our latest stock recommendation. In this essay, we describe the methodology, the technology, and the results of this experiment.

Methodology:

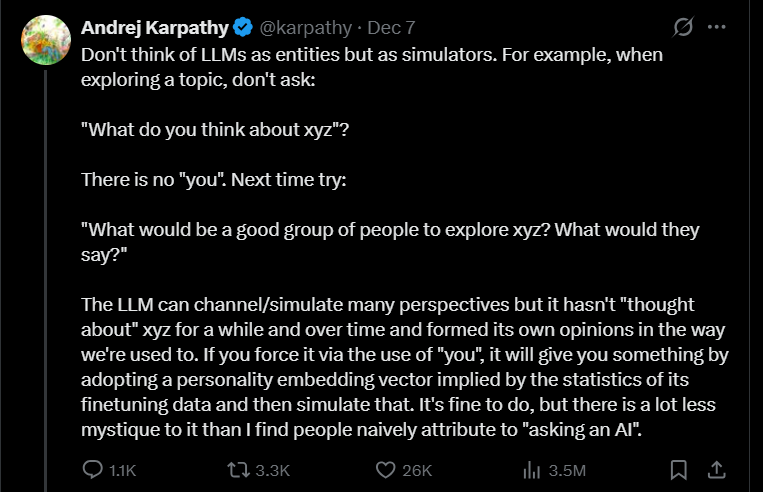

Our core methodology treats the model as a simulator, not as an oracle with its own opinions, in line with Andrej Karpathy’s point below. Instead of asking, “What stock do you like?”, we ask the model to produce a detailed description of a hypothetical “most investable” stock listed on the NYSE or Nasdaq.

The prompt asks it to simulate a panel of domain experts investors, technologists, industry analysts and to combine their perspectives into one idealized profile. This lets the model use its broad, cross-disciplinary knowledge of markets, technology, and industry structure to describe the financial, strategic, and qualitative traits such a company should have. We then use that simulated target profile as a blueprint and look for real stocks that most closely match it.

Below is the prompt we used to generate a description of a hypothetical “most investable” stock on the NYSE or Nasdaq. We ran this prompt in the Gemini app using the “Thinking with 3 Pro” mode.