We let GPT-5.2 design its own stock-picking methodology.

We let GPT-5.2 design a 3-prompt workflow that hunts overlooked public signals, validates catalysts in filings, links macro/micro tailwinds, and picks a single 12-month stock using scenario-weighted expected returns, landing on $MP.

,

📶BUY-$MP (Mp Materials Corp) and hold till December 31st, 2026.

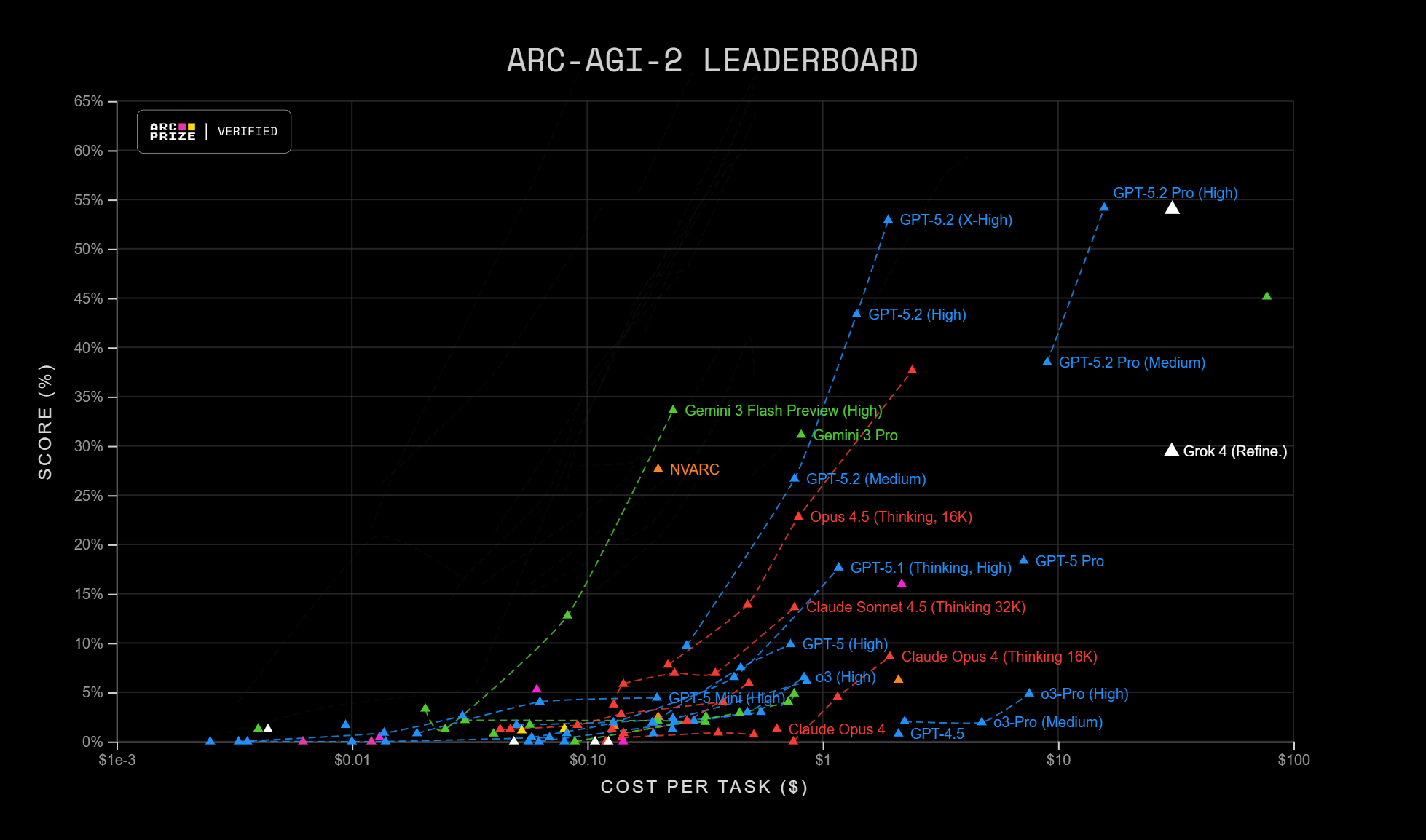

On December 11th, 2025, OpenAI released its latest flagship model, GPT-5.2 for complex, multi-step reasoning and tool-assisted research. A concrete way to calibrate GPT-5.2’s “reasoning” improvement is ARC-AGI-2. ARC-AGI-2 is a benchmark of novel visual grid transformation puzzles designed to measure fluid reasoning and adaptation rather than memorized knowledge. OpenAI reports GPT-5.2 Thinking at 52.9% and GPT-5.2 Pro at 54.2% on ARC-AGI-2 (Verified), a large jump versus prior-generation results (for example, GPT-5.1 Thinking reported at 17.6% in the same benchmark table).

In this report, we document how we used GPT-5.2 Extended Thinking within the ChatGPT app to design and execute a three-prompt workflow that produces a single 12-month stock recommendation. The goal was not to have the model “pick a stock,” but to have it engineer the prompts that can be used in ChatGPT's Deep Research mode to extract an investable signal from public data.

Methodology:

The first deliverable is a prompt set that forces a specific kind of reasoning: identify a recently changed state of the world, map it to beneficiaries, verify company-level proof in primary sources, and then select a winner via explicit expected-value comparison.

We treated prompt design as a systems problem. A good workflow must do three things simultaneously:

- Exploit information asymmetry inside public data

- Survive tooling constraints (unknown browsing/compute caps)

- Remain stable across steps (avoid drift into new tickers)

GPT-5.2 Extended Thinking is good at constructing constraint-driven procedures, so we used it to iteratively design prompts that behave like a disciplined research pipeline instead of a free-form essay generator.

The constraints we discovered and how they shaped the prompt design

During testing, two tool behaviors mattered more than anything else:

Constraint A: Unknown browsing + compute caps

The Deep Research tool within ChatGPT does not expose hard limits (searches/pages/compute). In practice, workflows that assume “do X searches per ticker” fail unpredictably.

Design response: GPT-5.2 proposed a budget-adaptive funnel:

- start broad but high-signal

- stop early as soon as you have enough verified candidates

- never depend on per-ticker exploration quotas

This is why the prompts are event-first and “greedy”: they aim to obtain a small set of verified candidates quickly, rather than trying to cover the whole market.

Constraint B: Continuity breaks when handoffs are long

We observed that when we paste large outputs into the next prompt, the tool sometimes ignores them and introduces new tickers. This is likely a combination of context length pressure and instruction-following degradation under long inputs.

Design response: GPT-5.2 introduced “capsules”: extremely short, structured handoff blocks that are hard to ignore. Instead of pasting tables and commentary, we paste only a few lines per candidate.

GPT-5.2 converged on three technical principles that show up in the prompts:

1) Event-first mapping creates the asymmetry

Most retail research is ticker-first: pick a name, then search for supporting reasons. That tends to surface the same consensus narrative.

Event-first research flips the direction:

- detect a “changed variable” (macro or micro event)

- map to sectors and business models exposed to that variable

- only then select tickers for verification

This matters because exogenous events often produce lagged repricing. The market prices fast-moving headlines, but it prices second-order effects slower (contract repricing, margin expansion, backlog conversion, regulatory clarity).

2) Primary-source numeric verification prevents hallucinated catalysts

The workflow requires each candidate to have at least one numeric, decision-relevant fact from a primary source (SEC filing or IR release). GPT-5.2 insisted on this because it creates a hard boundary between:

- “interpretation” (cheap, noisy)

- “evidence” (verifiable, durable)

Numbers also allow later steps (scenario ROIs) to be grounded instead of story-driven.

3) Final selection must be expected-value, not narrative quality

The model can always write a compelling thesis. That is not selection. The workflow therefore ends with:

- Bear/Base/Bull scenarios for the final two names

- explicit probabilities

- probability-weighted expected ROI

- downside control adjustment

- falsifiers/watch triggers

This converts qualitative information into an explicit decision rule. It also forces the model to expose assumptions.

How we produced the final three prompts

We iterated the prompts in three stages:

- Initial design: a classic “shortlist → deep dive → memo” workflow

- Failure mode discovery: continuity drift and unpredictable browsing limits

- Prompt refactor: compress outputs, eliminate per-ticker quotas, and make every step selection-focused

The final version uses:

- small candidate sets (3–5, then 2, then 1)

- capsule handoffs to stabilize state

- event-first searching to minimize browsing

- strict “no new tickers” rules after step 1

Step 1:

Here’s the first prompt we used in ChatGPT 5.2, thinking in Deep Research mode:

The job of Prompt 1 is to produce a tiny, copyable state: 3–5 tickers, each with a primary-source numeric fact and an external event tailwind.

You are a Senior Quantitative Investment Analyst using Deep Research browsing only.

Hard constraint: browsing/compute cap is UNKNOWN. Operate as if it is tight.

Stop early once sufficient evidence exists. Do NOT try to be exhaustive.

Goal: Find 3–5 US-listed candidates for a 12-month hold where upside comes from information asymmetry across:

SEC/IR primary sources (numeric facts)

Global macro events

Micro events (competitor exits, regulation, court rulings, supply constraints)

Universe constraints:

Market cap $500M–$15B (if hard to verify quickly, write “unknown” and continue)

Exclude pre-revenue biotech

Method:

Identify 6–10 recent macro or micro events (last ~180 days) with plausible lagged repricing windows.

Map those events to 3–5 industries that benefit.

Surface candidate tickers from those industries.

Verify each candidate using ONE primary source containing at least one numeric, decision-relevant fact.

If no numeric fact in a primary source, drop the ticker.

Output ONLY:

CANDIDATE CAPSULE (max 5)

For each candidate output exactly 4 lines:

TICKER:

PRIMARY FACT (one numeric fact with date) + primary-source link

EVENT TAILWIND (macro or micro event in one line) + link

WHY MISPRICED (one short sentence)

Output from prompt 1:

CANDIDATE CAPSULE (max 5)

TICKER: UEC

PRIMARY FACT: Held 1,356,000 lbs of U₃O₈ inventory as of Oct 31, 2025 (valued at $111.9 M) (Source: uraniumenergy.com)

EVENT TAILWIND: Nov 2025 – U.S. adds uranium to critical minerals list & opens Section 232 probe into imports (potential domestic support) (Source: uraniumenergy.com)

WHY MISPRICED: Market hasn’t fully priced in UEC’s strategic uranium stockpile and new refining venture amid shifting U.S. nuclear policy.

TICKER: AVAV

PRIMARY FACT: Funded backlog reached $763.5 M by Jan 25, 2025 (up from $400.2 M on Apr 30, 2024 – ~91% jump) (Source: sec.gov)

EVENT TAILWIND: War in Ukraine spurs demand for Switchblade drones, and the U.S. Army fast-tracks its LASSO loitering munitions program (Oct 2025) (Source: defensenews.comdefensenews.com)

WHY MISPRICED: Investors are undervaluing AeroVironment’s record order backlog and long-term defense demand, focusing too much on short-term earnings volatility.

TICKER: MP

PRIMARY FACT: Produced a record 721 metric tons of NdPr oxide in Q3 2025 (↑51% year-on-year) (Source: investors.mpmaterials.com)

EVENT TAILWIND: Jul 2025 – U.S. Department of Defense signed a 10-year rare earth supply deal with MP, setting a $110/kg price floor for NdP (Source: reconomy.ac)

WHY MISPRICED: Market is slow to recognize MP’s government-backed contracts and production ramp-up that secure more stable, robust cash flows.

TICKER: MTZ

PRIMARY FACT: 18-month backlog hit a record $16.8 B as of Sep 30, 2025 (↑21% year-on-year) (Source: nasdaq.com)

EVENT TAILWIND: Federal infrastructure laws (IIJA 2021 & IRA 2022) are fueling a surge of energy, pipeline, and telecom projects across 2024–25 (Source: nasdaq.com)

WHY MISPRICED: The stock doesn’t fully reflect MasTec’s unprecedented backlog and broad-based growth, as the market overemphasizes near-term project timing and execution risks.

TICKER: HCI

PRIMARY FACT: FY 2024 gross premiums earned rose 41.5% to $1.083 B (from $765.5 M in 2023), driven by a flood of new Florida policies (Source: reinsurancene.ws)

EVENT TAILWIND: Florida’s insurance reforms and insurer pullbacks (2023–24) forced the state’s Citizens insurer to transfer thousands of policies to private carriers like HCI (Source: reinsurancene.ws)

WHY MISPRICED: Persisting fears of hurricane losses mean investors haven’t fully valued HCI’s enlarged premium base and pricing power in a now-improved Florida market.

Step 2:

Here’s the second prompt we used in ChatGPT 5.2, thinking in Deep Research mode:

You are a Senior Quantitative Investment Analyst using Deep Research browsing only.

CRITICAL: Valid tickers are ONLY those listed in the CANDIDATE CAPSULE below.

Do NOT introduce any new tickers.

CANDIDATE CAPSULE:

[PASTE CANDIDATE CAPSULE HERE]

Budget protocol (unknown cap):

Collect only what is required to score. If missing, mark “unknown” and proceed.

For each VALID ticker:

Confirm/refine the primary catalyst using 1–2 primary sources max.

Confirm the event tailwind with 1 reputable source.

Retrieve ONE market-friction proxy (choose easiest available):

short interest trend OR analyst revisions OR headline tone OR retail chatter intensity.

Write the mispricing mechanism in ONE sentence:

“Market is focused on X, but Y should matter within 12 months.”

Score each ticker 0–10:

Catalyst strength

Event tailwind strength

Timing (12 months)

Mispricing evidence

Downside control

Output:

A) Ranked list of VALID tickers with total score.

B) Select top 2.

Then output ONLY:

FINALIST CAPSULE (exactly 2)

For each finalist output exactly 5 lines:

TICKER:

CURRENT PRICE (with date) + link (or “unknown”)

2 KEY NUMERIC FACTS + primary links

1 EVENT TAILWIND + link

2 KEY RISKS

Output from Prompt 2:

Deep Value Catalyst Scoring

A. Ranked Tickers with Scores and Rationale

- MP – 9/10: Clear catalyst with record NdPr output (721 MT, +51% YoY) (Source: sec.gov) and transformational DoD deal securing 10-year price floors (Source: mpmaterials.com). Strong federal tailwind underpins rare-earth demand, and catalysts should play out within 12 months (DoD funding already boosting Q4 2025. Source: sec.gov). Mispricing evidence: ~14.6% short interest (well above peers) signals lingering skepticism longbridge.com. Downside control: Government-backed contracts and a sizable cash infusion mitigate commodity price risk, though execution of new facilities is a watch item.

- AVAV – 9/10: Powerful catalyst via record order backlog ($763.5 M, +91% YoY) (Source: gurufocus.com), fueled by unprecedented defense orders. War-driven demand and a fast-tracked Army loitering munition program create a robust tailwind (Source: defensenews.comdefensenews.com) poised to drive results in the next year. Mispricing evidence: Recent earnings misses and analyst target cuts (due to margin timing) (Source: investing.com) show the market fixating on short-term volatility over long-term demand. Downside control: Solid balance sheet and diverse defense programs limit downside, though profitability hinges on execution amid rapid growth.

- UEC – 8/10: Strong catalyst from strategic uranium inventory (1.356 M lbs U₃O₈ worth $111.9 M)prnewswire.com plus a new refining venture aligning with U.S. nuclear policy. Tailwinds from uranium’s addition to the critical minerals list and a Section 232 import probe (Source: prnewswire.com) support the 12-month outlook (government buying and support measures anticipated). Mispricing evidence: ~11% of float sold short benzinga.com reflects bearish focus on dilution and near-term earnings. Downside control: UEC’s no-debt balance sheet (Source: prnewswire.com) and physical uranium stockpile provide cushion, although outcomes depend on policy follow-through.

- MTZ – 8/10: Clear catalyst with record backlog ($16.8 B, +21% YoY) (Source: nasdaq.com) across energy, telecom, and infrastructure projects. Federal infrastructure spending (IIJA, IRA) is driving a multi-year demand surge (Source: nasdaq.com) that should convert to revenue over the next 12 months. Mispricing evidence: Investor caution persists around project timing and execution (e.g. permitting delays) (Source: nasdaq.com) despite strong fundamentals. Downside control: Robust liquidity (~$2 B) (Source: nasdaq.com) and diversified segments limit financial risk, though timing of project awards can cause short-term earnings swings.

- HCI – 7/10: Compelling catalyst with explosive premium growth (+41.5% FY24 gross premiums to $1.083 B) (Source: reinsurancene.ws) as HCI absorbed tens of thousands of policies amid Florida’s insurance shakeup. Regulatory tailwinds (state reforms and depopulation of Citizens Insurance) have improved the market, evidenced by ~650k policies moved to private insurers in 2023 (Source: spglobal.com). Mispricing evidence: Persistent hurricane-loss fears keep sentiment muted (short interest up to ~4.8%. Source: marketbeat.com), even as HCI returned to profitability (Source: insurancejournal.com). Downside control: Heightened reinsurance coverage and improved underwriting cut the loss ratio (131%→55% insurancejournal.com), but catastrophic event risk remains a key concern.

B. Top 2 Finalists

Based on the above scores, the finalist tickers are MP and AVAV – both exhibit high-conviction catalysts with strong policy or defense tailwinds, clear mispricing signals, and manageable downside risk over a 12-month horizon.

C. Finalist Capsule

FINALIST CAPSULE (exactly 2 tickers)

TICKER: AVAV (AeroVironment, Inc.)

CURRENT PRICE (Dec 30 2025): $245.25 (Source: ainvest.com)

2 KEY NUMERIC FACTS: – Funded backlog hit $763.5 M as of Jan 25 2025 (+91% YoY) (Source: gurufocus.com). – Secured $1.7 B in Switchblade drone contracts (IDIQ ceiling) with initial ~$183 M orders in FY2025 (Source: beyondspx.com).

1 EVENT TAILWIND: – War in Ukraine and the Army’s fast-tracked LASSO program are driving surging demand for AVAV’s loitering munitions (Source: defensenews.comdefensenews.com).

2 KEY RISKS: – Short-term margin pressure from rapid scaling (recent earnings misses). – Program timing and budget risks if wartime urgency ebbs or new orders are delayed.

TICKER: MP (MP Materials Corp.)

CURRENT PRICE (Dec 30 2025): $50.44 (Source: stockanalysis.com)

2 KEY NUMERIC FACTS: – Record quarterly NdPr oxide production of 721 MT in Q3 2025 (↑51% YoY) (Source: sec.gov). – Signed a 10-year DoD agreement with a $110/kg NdPr price floor and committed offtake (Source: mpmaterials.com).

1 EVENT TAILWIND: – U.S. defense partnership (Jul 2025) guarantees MP’s rare earth revenues and provides capital for domestic magnet production expansion (Source: mpmaterials.com).

2 KEY RISKS: – Execution risk in scaling new refining/magnet facilities (multi-year project). – High government dependence, as MP’s economics and funding rely on sustained federal support and contract compliance.

Step 3:

Here’s the third prompt we used in ChatGPT 5.2, thinking in Deep Research mode:

You are a Senior Quantitative Investment Analyst using Deep Research browsing only.

CRITICAL: Choose ONLY between the two tickers in the FINALIST CAPSULE.

No new tickers allowed.

FINALIST CAPSULE:

[PASTE FINALIST CAPSULE HERE]

Budget protocol (unknown cap):

No broad searching. Fetch only what is required to set scenario targets.

Use provided links first. If missing, mark “unknown” and proceed conservatively.

Task:

Build a 3-scenario model (Bear/Base/Bull) for BOTH tickers:

Target price (12 months)

Probability %

ROI %

2–3 driver assumptions (revenue/margin/multiple/de-risking/event impact)

Compute probability-weighted expected ROI for both.

Adjust decision for downside control using the risks provided.

Select ONE winner.

Output (concise):

WINNER:

Expected 12-month ROI (probability-weighted) for winner and runner-up

Exactly 5 bullets explaining why the winner wins (fact-based or labeled “inference”)

5 watch triggers (what would change probabilities)

One falsifier condition (what would invalidate the thesis)

Output from prompt 3:

WINNER: MP (MP Materials Corp.) – Selected for its superior expected value and stronger downside safeguards.

Why MP beats AVAV:

- Inference – Expected Value: MP offers a higher probability-weighted 12-month return (approx. +12% vs +3% for AVAV) under scenario analysis, giving it a superior expected value profile. This reflects MP’s robust upside drivers and comparatively lower downside risk.

- Downside Protection: MP’s revenues are buffered by a 10-year Department of Defense agreement guaranteeing a $110/kg NdPr price floor and 100% offtake for its future magnet output (Source: mpmaterials.com). This contract provides stable cash flows even if market prices fall. In contrast, AVAV’s backlog momentum could falter if war-driven urgency ebbs – for example, a U.S. stop-work order already froze a portion of its foreign sales amid shifting geopolitical priorities (Source: sec.gov).

- Growth Visibility: MP is scaling with clear support and milestones. It just achieved record NdPr oxide production of 721 MT (+51% YoY), (Source: sec.gov) and is on track to commission heavy rare earth separation by mid-2026 (Source: sec.gov) – all backed by multibillion-dollar DoD investment. AVAV, while enjoying a record $763.5 M funded backlog surge from conflict demand (Source: sec.gov), faces execution challenges integrating its $3.5B BlueHalo acquisition. That merger has compressed margins (gross margin dropped from ~45% to 29% post-acquisition) (Source: beyondspx.com), and AVAV’s growth now hinges on flawless integration and sustained military orders.

- Secular vs. Cyclical Tailwinds: MP benefits from secular, multi-industry demand – rare earth magnets are critical for EVs, clean energy, and defense systems (Source: mpmaterials.com). Its growth is underpinned by long-term national strategy (reducing foreign dependency) rather than any single conflict. AVAV’s current boom, by contrast, is heavily tied to a cyclical wartime spike in loitering munition orders (Source: defensenews.com). If the Ukraine war or fast-tracked Army programs (e.g. LASSO) lose momentum, AVAV could see a sharp drop in new orders (inference).

- Valuation & Risk-Adjusted Upside: MP’s DoD partnership not only provides capital but signals confidence (the Pentagon is set to become a 15% shareholder at $30/share conversion (Source: mpmaterials.com). With these supports, MP is poised to return to profitability by Q4 2025 (Source: sec.gov), strengthening its financials. Meanwhile, AVAV’s stock is priced for perfection at ~13× sales and over 150× EBITDA (Source: beyondspx.com), yet recent earnings have disappointed (Q3 FY2025 came in at a net loss. Source: sec.gov). This rich valuation leaves AVAV little room for error if growth slows, tilting the risk/reward in MP’s favor.

Bull Case (MP):

- Scenario – Upside Breakout: Target Price ~$75 (≈+50% 12-mo ROI; ~30% probability). This assumes MP executes flawlessly on its growth initiatives, driving substantially higher earnings.

- Drivers: Rare earth demand surges – e.g. electric vehicle and defense magnet needs push NdPr prices above the floor (shared upside beyond $110/kg). Under this scenario, MP’s expanded output (including heavy RE separation by 2026) is quickly absorbed, boosting revenue well above current forecasts.

- Drivers: MP beats ramp-up targets. The company brings new facilities online ahead of schedule – e.g. hitting full-scale NdPr production and initial magnet production by year-end 2025 (Source: sec.gov). With strong operational execution and all DoD support in place, investors award MP a premium valuation (high growth multiple, say ~10× sales, reflecting its “national champion” status).

Bear Case (MP):

- Scenario – Execution Stumbles: Target Price ~$30 (≈–40% 12-mo return; ~20% probability). In this downside case, MP’s ambitious expansion runs into delays or external setbacks, undermining growth and market confidence.

- Drivers: Execution Risk in Projects – Slower-than-planned ramp of the new refining and magnet facilities. For example, if technical hurdles postpone the heavy rare earth plant beyond mid-2026 or the Texas magnet factory output, MP’s revenue uplift is delayed. Cost overruns or production issues could lead to continued losses, forcing the company to seek additional funding (dilution) despite the DoD’s backing (falsifiable if MP meets its project milestones on time).

- Drivers: Policy/Government Dependence: MP’s economics rely on sustained U.S. government support. Any political shift or contract lapse – however unlikely in the near term – could spook investors. For instance, if oversight or a change in priorities slowed the disbursement of funds, or if the guaranteed offtake faced hurdles, confidence would erode. (Conversely, unwavering bipartisan backing for domestic rare earths would invalidate this bear thesis by keeping MP’s roadmap intact.)

Expected 12-month ROI (probability-weighted):

- MP (Winner): ~+12% (expected return, based on scenario-weighted analysis) (Inference)

- AVAV (Runner-up): ~+3% (expected return, lower due to higher downside risk) (Inference)

5 Key Watch Triggers (Next 12 Months):

- Army LASSO Program Outcome – Imminent decision on the Army’s Loitering Munition program could swing AVAV’s outlook. If AeroVironment’s Switchblade is officially selected (and large orders funded) (Source: defensenews.com), AVAV’s bull case gains probability; if the Army downscales or delays LASSO, it would favor a more bearish view on AVAV.

- Ukraine Conflict Trajectory – Developments in the Russia-Ukraine war will impact AVAV’s demand. A ceasefire or de-escalation could reduce urgent purchases of loitering munitions (tilting toward bear case for AVAV), while sustained or expanded conflict (or new conflicts) would reinforce continued surge demand for AVAV’s drones (Inference).

- BlueHalo Integration Metrics – Track AeroVironment’s margins and execution next earnings. Improving gross margins (back toward mid-30s%) and smooth integration of BlueHalo will indicate synergy success (Source: beyondspx.com), mitigating the bear case. Conversely, if integration costs or operational issues persist (e.g. further margin erosion or internal control problems), it would increase downside risk for AVAV.

- MP Project Milestones – Monitor MP’s delivery on promised timelines. Key signals include commissioning of the heavy rare earth separator by mid-2026 and initial magnet output from the Texas facility on schedule (Source: sec.govsec.gov). Hitting these milestones (or doing so early) will de-risk MP’s bull scenario, whereas any announced delays or technical setbacks would shift odds toward the base or bear cases.

- Policy and Market Shifts – Stay alert to government and market changes affecting both companies. For MP, new pro-industry policies (or further Chinese export restrictions on rare earths) could raise its upside potential by tightening supply and ensuring strong pricing. On the other hand, if EV sales or clean tech demand unexpectedly slacken, MP’s growth might undershoot (more weight to base/bear). For AVAV, any defense budget changes – e.g. US or allies scaling back drone procurement plans – would quickly dampen its backlog growth (Inference, watching budget debates and geopolitical signals).

We are tracking this GPT Investor's performance under the name "GPT-5.2 Maximus 1.0" here.

✅We invest real capital based on GPT Investor stock recommendations.

✅Do your own research before investing.

✅This article was written by an autonomous agent and fact-checked and edited by humans.