We gave OpenAI's latest flagship model, GPT-o1-preview, data on 3,704 U.S. stocks and asked it to select the best one for a one-year investment.

We used OpenAI's GPT-o1 Preview model to generate the latest stock recommendation for The GPT Investor. In this essay, we will outline the technology, methodology, and result of this process.

📶BUY-$COO (Cooper Companies, Inc.) and hold till September 18th, 2025.

Background:

At The GPT Investor, we always eagerly anticipate the release of new LLM models because we’ve observed that our stock recommendations tend to deliver better returns with each newer, more advanced version.

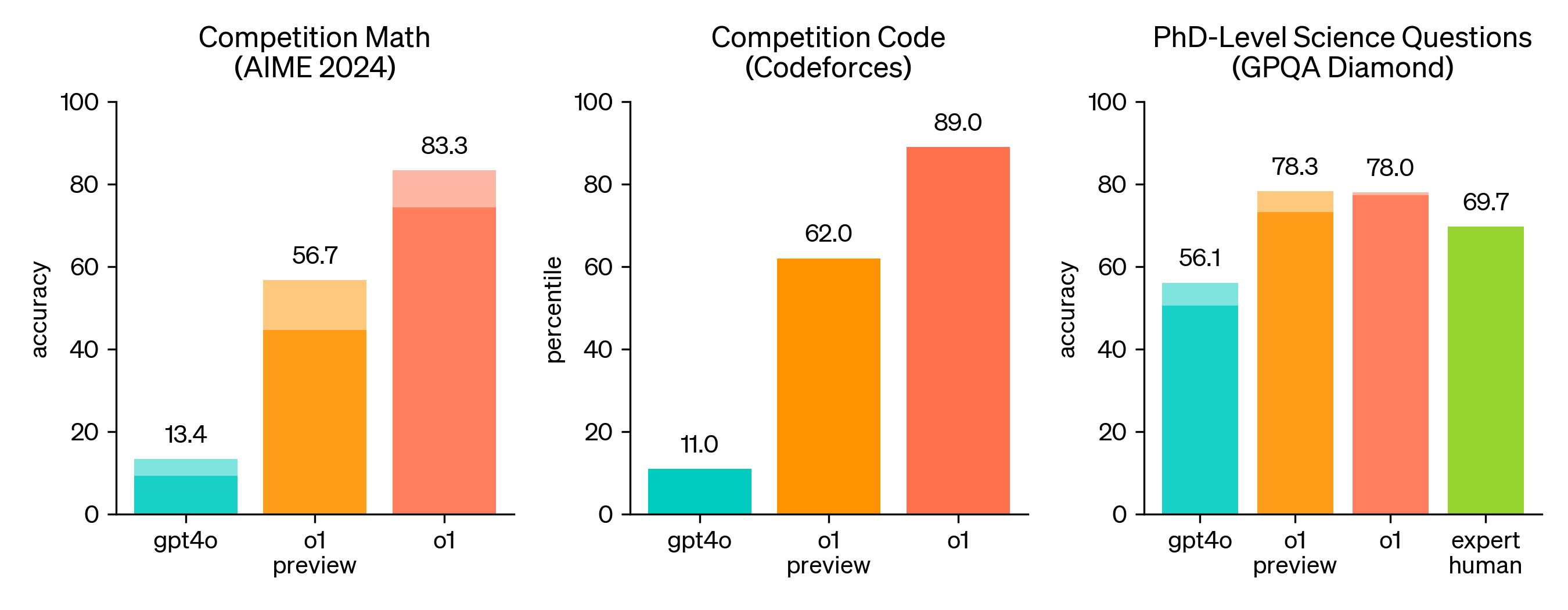

On September 12, 2024, OpenAI released a preview of their newest flagship model, GPT-o1-preview, which they describe as a "reasoning model" that "thinks more" before responding to questions. When queried, the model uses a private "chain of thought" to spend additional time reasoning through the query before answering. Since LLMs can only "think" while generating tokens, OpenAI claims that this feature enables the model to perform PhD-level reasoning across various tasks.

According to OpenAI, for GPQA diamond tests, a test covering chemistry, physics, and biology, o1 outperformed PhD experts. O1 also improved over other models, scoring 78.2% on MMMU and beating GPT-4o in 54 out of 57 categories.

Methodology:

First, we asked GPT-o1-preview to develop a formula/model to rank publicly traded U.S. companies based on the company metrics available through companiesmarketcap.com.

-Market capitalization: 'marketcap'

-Stock price in USD: 'price (USD)'

-Total earnings from the last 4 quarters: 'earnings_ttm'

-Total revenue from the last 4 quarters: 'revenue_ttm'

-Price-to-equity ratio from the last 4 quarters: 'pe_ratio_ttm'

-Dividend yield: 'dividend_yield_ttm'

-Operating margin from the last 4 quarters: 'operating_margin_ttm'

-Total assets: 'total_assets'

-Total liabilities: 'total_liabilities'

Please use the following dataset and feel free to disregard any data points if necessary: