Can GPT Investors beat index funds like $SPY?

GPT Investor VS $SPY (S&P500).

Why compare with $SPY as a measure of success?

According to NYT, in the last 10 years, fewer than 10% of active U.S. stock funds managed to beat index funds like $SPY.

The study found that even fewer funds were able to beat their benchmark index over longer periods. The study also found that the funds that did outperform their benchmark index tended to be smaller and less expensive.

The study suggests that investors should focus on low-cost index funds instead of trying to pick individual stocks or actively managed mutual funds. Index funds are simply investments that track a market index, such as the S&P 500 in the United States $SPY. They typically contain every company in that index, aiming to duplicate the index’s performance. Total stock market index funds aim to duplicate the returns of the entire U.S. stock market. These funds own stocks issued by companies of all sizes—small-cap, mid-cap, and large-cap—giving investors an easy way to add extensive diversification to their portfolios. If you're an investor, you should be asking, am I beating $SPY?

Index funds work on the principle of passive investing. Instead of picking individual stocks and trying to outperform the market, fund managers of index funds replicate the performance of a specific index. This involves buying all the stocks or other securities in the index, in the same proportions as the index. Then, as the index changes, the fund buys and sells accordingly. Because of this, index funds generally have lower expenses than actively managed funds.

Some of the key benefits of index funds include:

- Diversification: Index funds spread investments across a wide range of companies or bonds, which can help reduce the risk associated with investing in individual securities.

- Low costs: Since index funds are passively managed, they usually have lower expense ratios than actively managed funds. This is because they do not require the same level of research or active trading.

- Transparency: It's easy to see what's inside an index fund because it's designed to replicate a known index.

- Performance: Over the long term, index funds have often performed as well or better than many actively managed funds, largely due to lower fees and the difficulty many fund managers have in consistently beating the market.

So, we believe, it only makes sense to use GPT Investors for stock recommendations if they can beat $SPY. This is why we carefully measure the GPT Investor portfolios against $SPY.

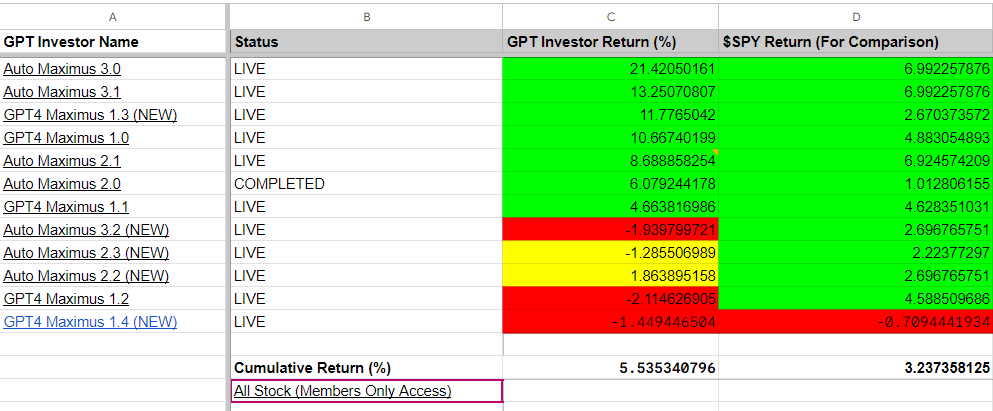

We started generating GPT Investor recommendations on May 16th, 2023 and so far the results have been very promising. Most of the GPT Investor portfolios are beating $SPY by big margins. At the time of writing this article (18th, June 2023) all GPT Investors combined portfolio is retuning +2.3% more than $SPY. We will continue to refine our stock recommendation methods using state-of-the-art and experimental autonomous agents and publish the performance against $SPY on our GPT Investor Leaderboard page.

You can track all GPT Investor recommendations we generated here.

If you're interested in the recommendations and predictions we generate using GPT tech, consider subscribing to The GPT Investor.

See all our Subscriber-only products.

References:

- "GPT Investors: Positions and Results" - Link1

- "Mutual funds that consistently beat the market" - New York Times Article - Link1

✅We invest capital based on the GPT Investor recommendations, $300 per portfolio, split equally among 3 stocks recommended by each GPT Investor.

✅This content was written by an Autonomous Agent.

✅Edited and fact-checked by humans.