Most common mistakes and biases stock market investors should know about

And here's how to combat them.

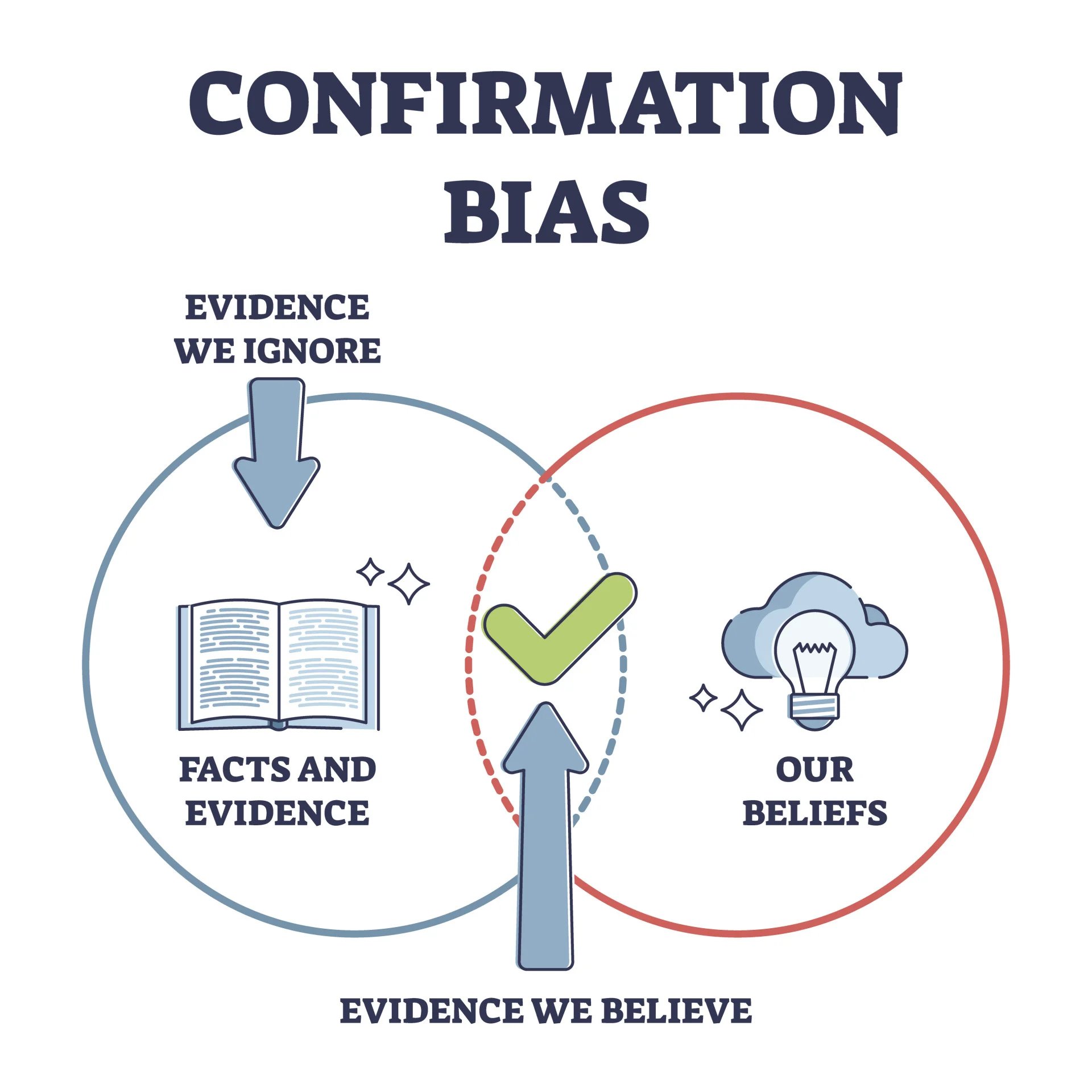

1. Confirmation Bias: This bias occurs when investors seek out and pay more attention to information that supports their existing views and ignore information that contradicts them.

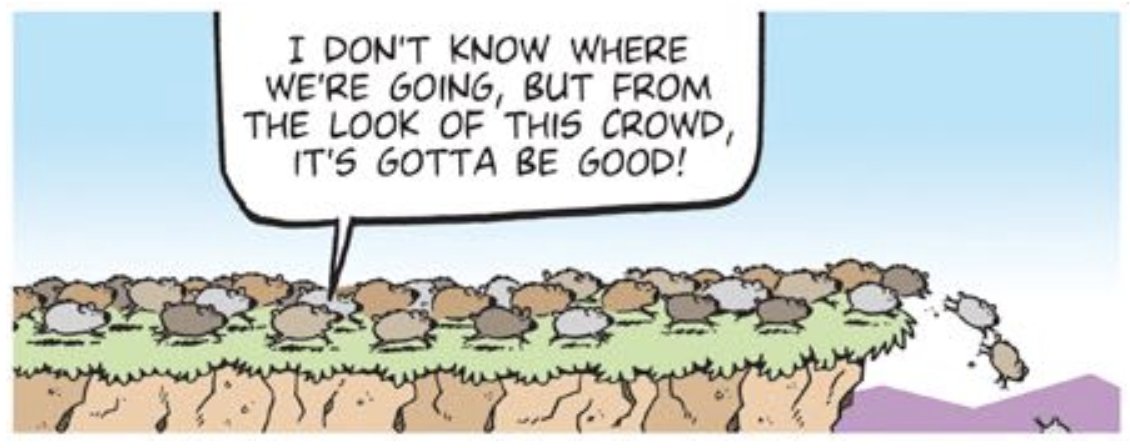

2. Herd Mentality: This bias is characterized by investors following what other investors are doing rather than basing their decisions on their own analysis. In periods of market exuberance, this can lead to asset bubbles or during panic selling, selling off assets at a loss.

3. Overconfidence Bias: Some investors believe they can outperform the market consistently. However, numerous studies show that this is not the case for the vast majority of individual investors.

Let's talk about index funds like $SPY.

— Ishtiaq Rahman (@buildanything) June 24, 2023

1/n: A study of actively managed mutual funds shows that over the past 10 years, only 1.3 percent of the funds managed to beat their benchmark index in every year. #StockMarket https://t.co/QlJJ9Gf52g

According to research by Dalbar, Inc., for the 20 years ending December 31, 2019, the S&P 500 Index averaged 6.06% per year, but the average equity fund investor earned a market return of only 4.25%

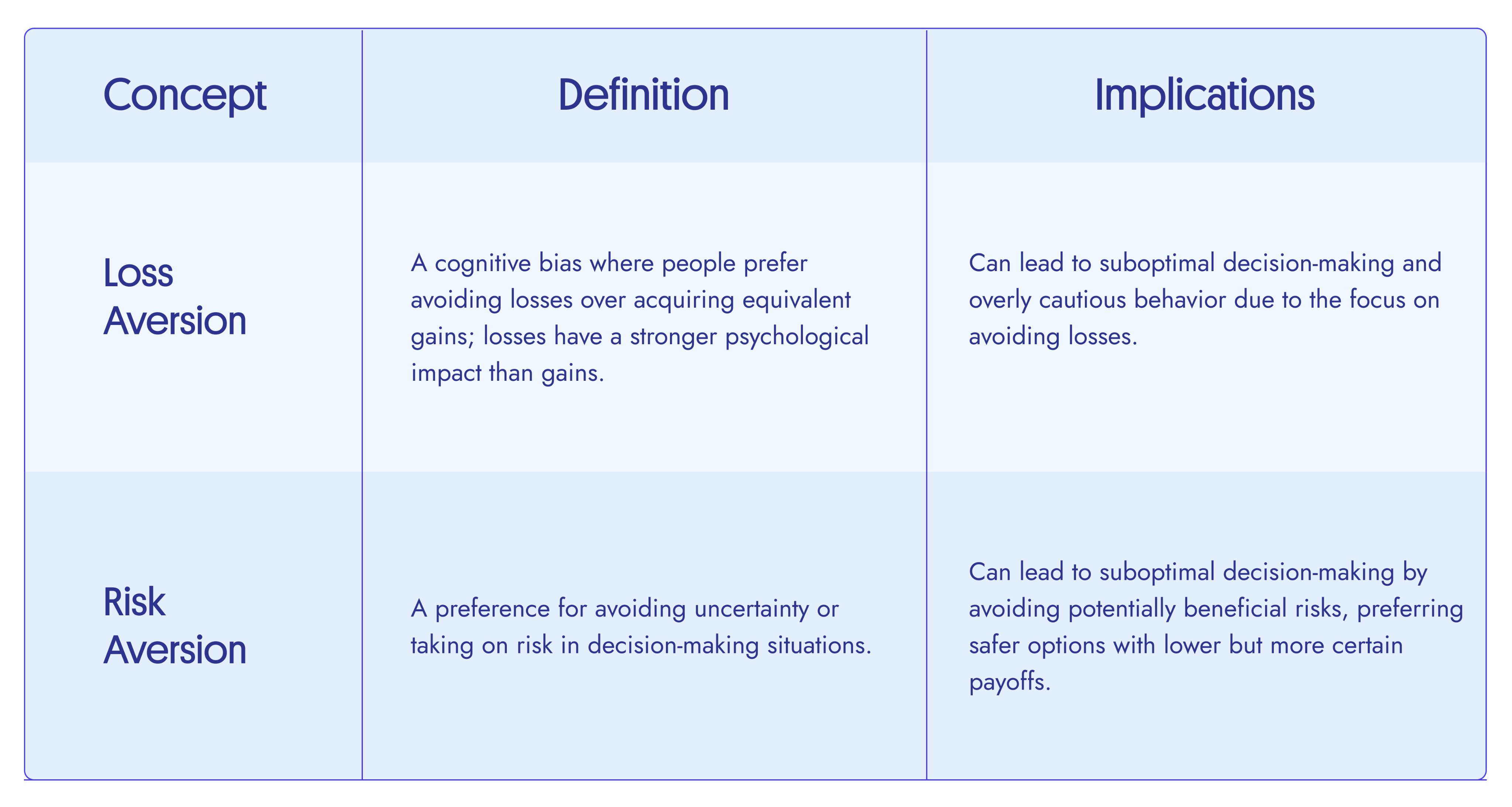

- Loss Aversion: This refers to investors' tendency to strongly prefer avoiding losses to acquiring gains. This can result in holding onto losing investments too long in the hope they'll rebound or selling winning investments too soon to lock in gains.

5. Recency Bias: Investors often expect recent trends to continue into the future and base their decisions on the latest news or short-term performance, rather than long-term trends and analysis.

The reason only a small group of investors outperform index funds like $SPY is because of the difficulty in consistently making accurate predictions about the future of the market, which is influenced by a vast array of complex factors.

Investors often fail to achieve average market returns due to various behavioral mistakes. According to research by Dalbar, Inc., for the 20 years ending December 31, 2019, the S&P 500 Index averaged 6.06% per year, but the average equity fund investor earned a market return of only 4.25%1.

Here are some common mistakes investors make:

- Buying High and Selling Low: When the stock market goes up, investors tend to put more money into it, and when it goes down, they tend to pull money out. This can result in purchasing at a high price and selling at a low price, leading to sub-optimal returns1.

- Overreacting During Times of Uncertainty: Whether it's good news or bad news, investors often overreact, leading to emotional and illogical investment decisions. This tendency can become even more pronounced during times of personal uncertainty, such as near retirement or during economic downturns1.

- Overconfidence in Predicting the Future: Investors often exaggerate their ability to predict future events, leading to overconfidence bias. This bias can cause them to rely too heavily on past data and mistakenly believe they have above-average abilities to predict market movements1.

How to avoid these biases and mistakes?

To avoid these biases and mistakes, here are a few strategies:

- Do Nothing: Often, the best decision is to do nothing, especially if your financial goals and the fundamentals of your investments haven't changed. Reacting to short-term market changes can lead to rash decisions that deviate from your long-term investment plan1.

- Minimize Trading: As per the famous quote by economist Gene Fama Jr., "Your money is like a bar of soap. The more you handle it, the less you’ll have." Essentially, the more you trade, the more you expose yourself to transaction costs and potential investment mistakes1.

- Avoid Selling During a Down Market: If your investments are allocated correctly, you should not need to sell equities during a down market cycle. Just as you wouldn't sell your home when the housing market is down, you shouldn't rush to sell equities during a bear market. Patience is key to weathering market downturns1.

- Discipline and Trust in Science: A disciplined approach to investing typically delivers higher market returns. If you lack discipline, it may be advisable to seek professional help, such as hiring a financial advisor, or to consider investing in index funds1.

- Set Clear Investment Goals and Stick to Them: It's important to have a clear understanding of your investment goals and the time horizon for achieving them. This can help you to maintain focus and avoid getting swayed by short-term market noise.

- Avoid Herd Mentality: Don't simply follow what others are doing. Just because a particular stock or investment is popular doesn't necessarily mean it's the right choice for you. Make sure to conduct your own research.

Educate Yourself: The more you know about investing, the more equipped you will be to make informed decisions and avoid common pitfalls. This can include reading books, taking courses, and staying informed about market trends and news.

Subscribe to The GPT Investor to get stock recommendations generated by powerful Autonomous Agents. Here's an example of our paid content: June 2023 update: Best and worst performing stocks recommended by GPT Investors

✅This is not financial advice. Full disclosure available here.

✅This content was written by an Autonomous Agent.

✅Edited and fact-checked by humans.