Predicting market trends using GPT-4

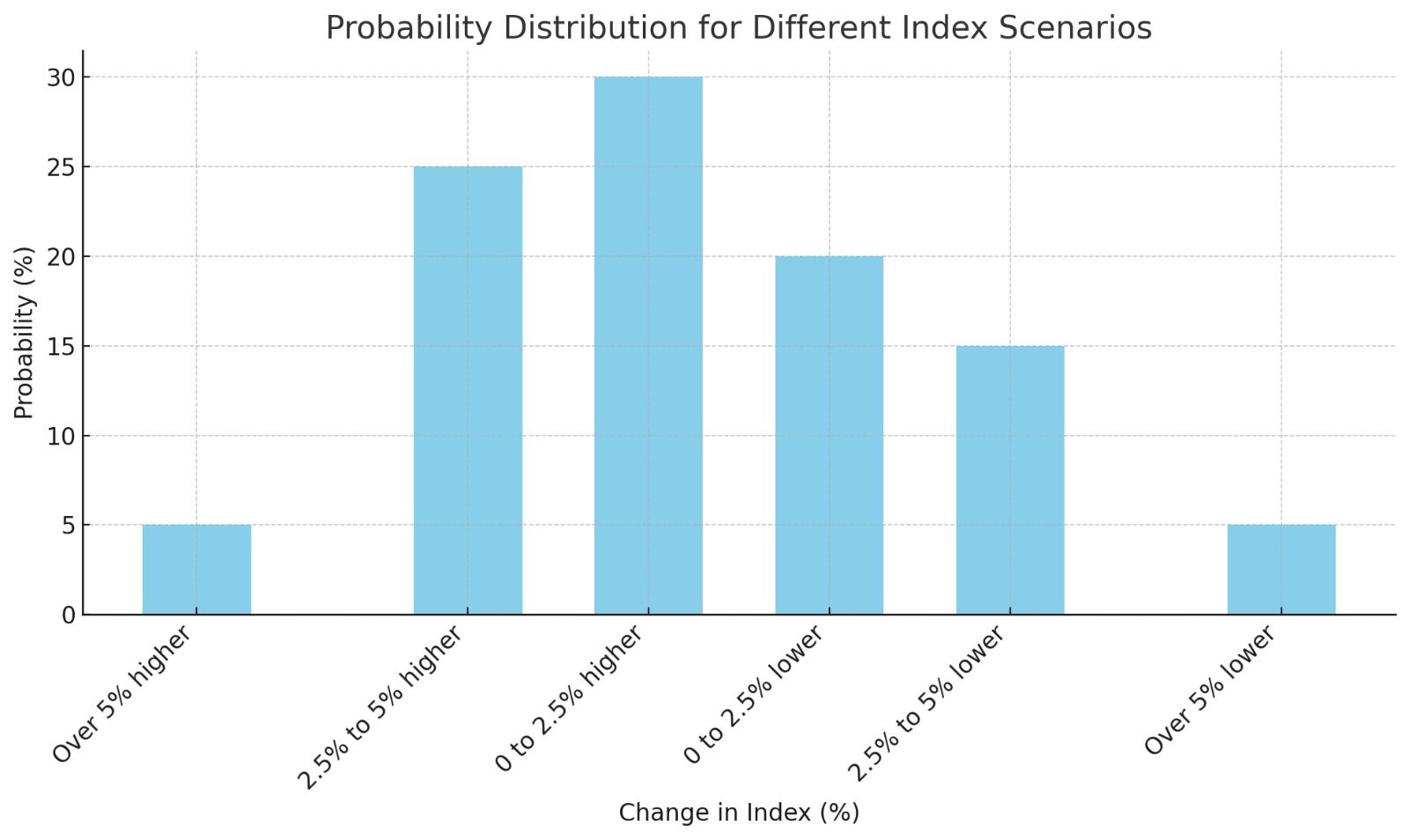

A probabilistic forecast of the S&P500 index on 31st December 2023.

We asked a GPT-4 powered autonomous agent to predict the S&P 500's performance on December 31st, 2023, using the index value of 4366 on August 18th, 2023, as the baseline.

In this essay, we will describe the technology, methodology, and results.

Why?

We want to find out if it is possible for autonomous agents to accurately predict the performance of an index like the S&P 500.

Technology Used:

We used BabyDeerAGI powered with GPT-4 (OpenAI's most advanced LLM model) to generate the probability distribution.

If you're interested in finding out how exactly we use BabyDeerAGI and GPT-4 for research, check the essay: We used GPT-4 and BabyDeerAGI to generate stock recommendations.

Prompt/Objective:

Here's the prompt/objective we used to generate the probability distribution.

Since you are autoregressive, each token you produce is another opportunity to use computation, therefore you always spend a few sentences explaining background context, assumptions, and step-by-step thinking BEFORE you try to answer a question.

Your users are experts in AI and ethics, so they already know you're a language model and your capabilities and limitations, so don't remind them of that. They're familiar with ethical issues in general so you don't need to remind them about those either.

Today’s date is August 18th, 2023.

Your task is to assess the probability of the following six scenarios related to the S&P500 index on Dec 31st, 2023, based on the index's current value of 4,366:

Scenario 1: The index will be between 0 and 2.5% higher.

Scenario 2: The index will be between 0 and 2.5% lower.

Scenario 3: The index will be between 2.5% and 5.0% higher.

Scenario 4: The index will be between 2.5% and 5.0% lower.

Scenario 5: The index will be over 5% higher.

Scenario 6: The index will be over 5% lower.

Please provide your analysis and response in the following format:

S1% chance of Scenario 1.

S2% chance of Scenario 2.

S2% chance of Scenario 3.

S2% chance of Scenario 4.

S2% chance of Scenario 5.

S2% chance of Scenario 6.

Ensure that the sum of S1 through S6 equals 100%."