The Alpha-Divergence Protocol: We let Gemini-3 Pro design an autonomous stock research workflow

How we moved beyond basic prompts to build a forensic AI workflow that exploits the gap between headlines and reality, and the single high-conviction trade it uncovered.

📶BUY-$PSN (Parsons Corporation) and hold for 12 months till January 4th, 2027.

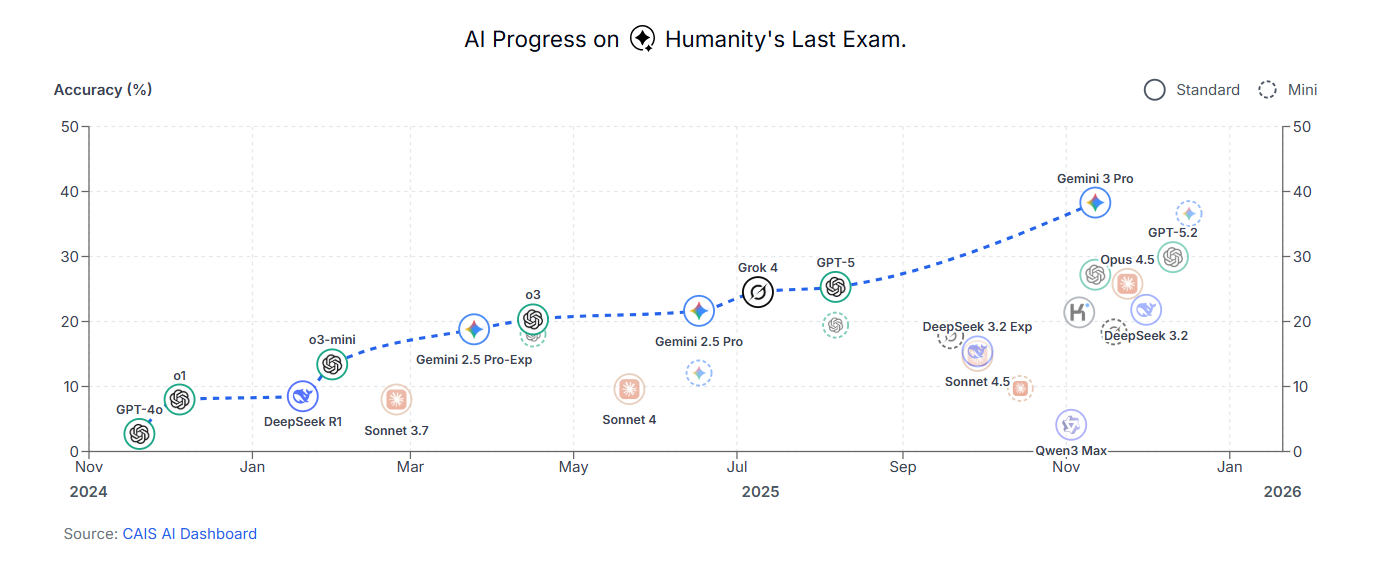

On December 11th, 2025, Google released Gemini 3 Pro, which immediately swept the leaderboards. It dominated almost every metric, including 'Humanity's Last Exam', a grueling multimodal benchmark designed to represent the final frontier of human knowledge with over 2,500 questions across 100+ subjects.

To generate the next GPT Investor stock recommendation, instead of designing the prompt ourselves, we asked Gemini 3.0 Pro to design it. Once the workflow was designed, we executed the workflow on the Gemini App using the Gemini 3.0 Pro model.

In this report, we document how we used the Gemini "Alpha-Divergence" Workflow—a specific 3-prompt sequence designed to exploit Information Asymmetry. The goal was not to ask the AI "what stock should I buy?", but to use it to come up with its own workflow and then execute it.

We executed this strategy on the morning of January 4th, 2026. Below is the methodology, the forensic filtering process, and the single high-conviction winner it uncovered.